One of Australia’s biggest super funds is backing nuclear tech – but not the kind being pitched by the federal Coalition.

Hostplus is investing in fusion energy.

CIO Sam Sicilia says a combination of tech advances in the last five years and a youthful member base means fusion is now a real option for big, patient investors.

“We have a confluence of events. We have stronger magnets, we have AI to control the plasma, we have better materials than we had in the past,” he told Renew Economy.

“The physics has been solved a long time ago. What was missing was the technology, the engineering know-how.”

Fusion power is the holy grail of energy technologies: it makes more energy than nuclear fission, produces less waste, doesn’t create anything that could be used in a weapon, and has zero risk of meltdown.

The truth is more complicated, not least because the longest ever sustained reaction was only achieved in January, when China’s “artificial sun” reactor in Heifei managed a whole 17 minutes.

But the industry still expects commercialisation to happen within 15 years and ultimately to produce electricity at less than $100 per megawatt hour (MWh), according to a survey last year of 45 fusion companies by the Fusion Industry Association.

And with almost half a billion dollars of funding sunk into the industry last year, the race is on for companies ranging from Commonwealth Fusion Systems – the MIT spinout that is leading so far and Hostplus’ investment pick – to Australian startup HB11.

AI, magnets make fusion power

Fusion was solved as a physics problem in the 1930s but only recently as an engineering problem, says Sicilia, a nuclear physicist himself.

Unlike nuclear fission, which creates energy by breaking an atom apart, fusion forces two nuclei together into one.

Reactions take place in a hot, charged gas called plasma and need extremely high temperatures above 100 million degrees Celsius – and a lot of energy – to take place.

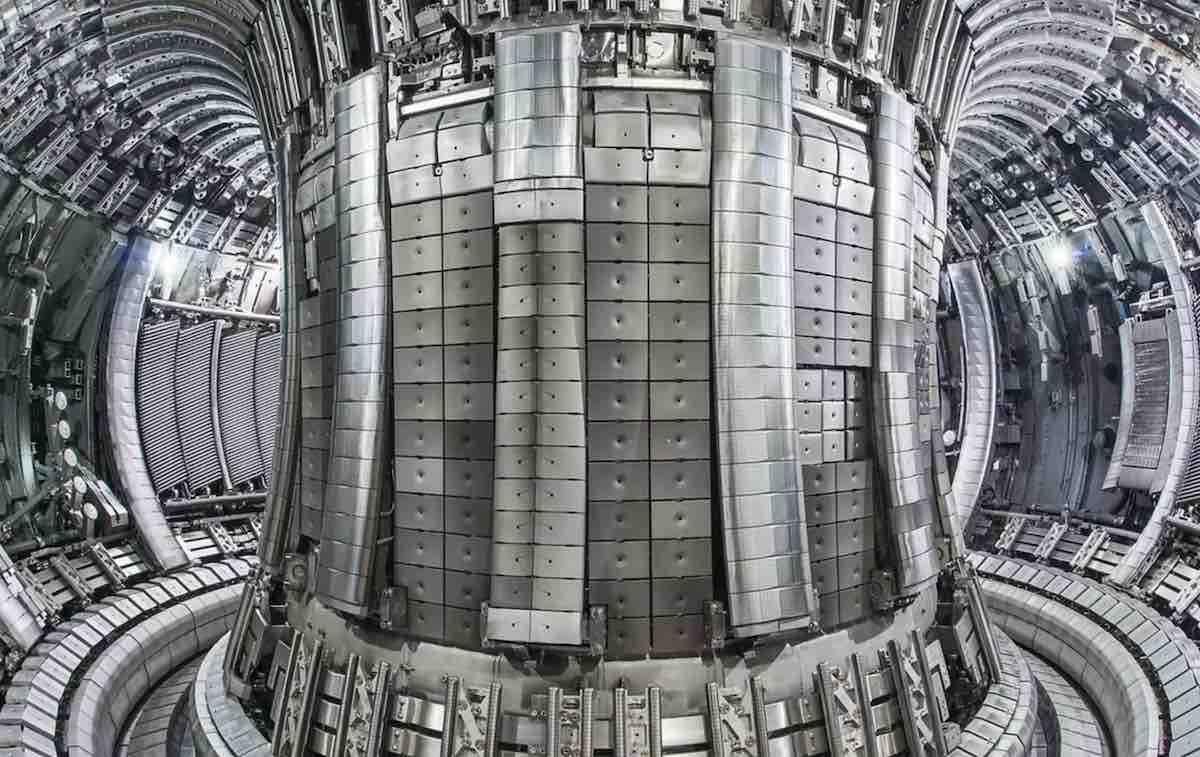

The two main reactors are a donut-shaped ‘tokamak’ which uses magnets and charged plasma and is more stable, and the more energy efficient stellarator which just uses external magnets.

Another method is laser fusion where powerful beams provide the heat.

China’s laser fusion facility in the southwest city of Mianyang will be 50 per cent larger than the National Ignition Factory in California. Image: Google Earth

One of the two main breakthroughs Sicilia believes were crucial to making fusion viable was the successful test of a superconducting magnet by MIT and Commonwealth Fusion Systems (CFS) in 2021. Strong enough to lift an aircraft carrier, the magnetic field prevents the super heated plasma from touching and melting its container.

The other is artificial intelligence (AI), which allows systems to react fast enough to anticipate and control the direction of the hot plasma as it breaks down, something human reactions simply aren’t quick enough to do.

Sicilia says the question now is whether the magnetic fields and AI controls can be scaled up to commercial scale power.

CFS believes it is: the company is building a prototype called SPARC on a site in Devons, Massachusetts, which is anticipated to generate 50-100 megawatts (MW) of power. It’s due to be finished by the end of 2026.

A second site in Virginia is where the full scale Arc plant will be finished around 2032, the company says.

The cryostat base is the first part of the SPARC tokamak reactor to be built. Image: CFS

If this sounds ambitious for a technology that just five years ago was still wrestling with major functional problems, it isn’t to people in the industry – even in Australia.

Patrick Burr leads the student project to build a donut-shaped tokamak fusion reactor – just a little one – at University of New South Wales (UNSW). He also works with Australia’s only home-grown fusion company, HB11 Energy.

He says commercialisation of fusion energy is now an engineering problem that requires money and people.

“What we need to achieve fusion in a commercial sense is a very large upskilling of a very large number of people, from fusion engineers to fusion scientists all the way down the constitution supply chain and that requires starting soon,” he told Renew Economy.

“We know this is a tractable problem, so we have all these companies racing to build the first fusion reactor [but] there’s not enough expertise to hire.”

Australia as a fusion power? Maybe

Matt Bungey is taking a bet that fusion energy will be ready for launch – in Australia – by the late 2030s.

Bungey is a partner at Western Australian venture fund Foxglove Capital and an investor in another fusion frontrunner, Type One, which recently set up an Australian subsidiary.

He believes fusion should be part of a diverse energy strategy even if by the late-2030s renewables and storage are the dominant generators.

But he does admit there is a deadline.

“There’s a timing element here, if you don’t get it right before the mid 2040s there’s a question of whether you really need it,” he says.

The other view is that Australia’s energy needs will scale in unimaginable ways as the demands of decarbonisation and AI require more electricity.

HB11 founder Warren McKenzie says the country must start investing now to be a player in a field he firmly believes is coming whether Australia wants nuclear or not.

The point [is that] in the construction of the world’s first of a kind fusion power plant will be an international project worth tens of billions of dollars and Australia has a really big opportunity to be involved in the supply chain of that,” he told Renew Economy.

“If Australia doesn’t participate in that, we will be an energy buyer in the second half of the century, not an energy producer.”

Today the global industry has attracted $US7 billion ($A11 billion) in funding, according to the FIA.

But even the $A130 billion Hostplus is merely dipping a toe in – its CFS investment is worth $US136 million.

Still, CFS CEO Bob Mumgaard says there is enough curiosity in the technology from within Australia to warrant a look here – even if nuclear power generally is still illegal.

“Australia is an interesting place because it has a lot of things that you want in an advanced energy system. It’s got a well established grid, it’s got well established energy tech, it’s got the rule of law, it has some [energy] needs that are highly concentrated,” he told Renew Economy.

“Mining and processing, how do you decarbonise that? There are still a lot of CO2 emissions from coal. Those are a lot of reasons why you’d look at Australia.”

Australia left the chat

The case for fusion in Australia could have been less equivocal had former prime minister John Howard not banned nuclear fission.

Australians and New Zealanders led fusion science from the very beginning.

Australian scientists Mark Oliphant and Paul Hartek created the first fusion reaction in 1932, under the guidance of nuclear luminary, New Zealander Ernest Rutherford at his lab in Cambridge.

Since then, Australia remained at the forefront of fusion science, building the only tokamaks outside the Soviet Union in the 1960s at Australian National University and demonstrating pioneering stellarator technology in the 1980s.

But the country left the fusion field after prime minister John Howard banned all nuclear power in October 1998.

Researchers slipped away to other countries, research programs disappeared, and Australia fell behind.

Australia enters the chat, with HB11

Australia does have its own fusion startup in HB11. It is forging a technology path quite different to those pursued by CFS (a tokamak design) or Type One (a stellarator).

HB11 is using lasers and a proton-boron fuel, rather than the more common deuterium/tritium, deuterium/deuterium, or deuterium/helium3 combos.

“The key difference between what we’re doing and what most of the other private fusion companies are doing is we’re using [boron] which does not produce neutrons,” McKenzie says.

Boron is abundant and costs about a dollar a kilogram, and the method of firing a laser at small pellets to create an ongoing reaction doesn’t make the materials around them radioactive – more on this later.

The HB11 laser fusion design. Image: HB11

McKenzie gently negs the tokamak and stellarator players, saying none have produced a net gain – more energy out than in – whereas laser fusion has, in December 2022 at the National Ignition Facility in California.

“The catch is it’s much harder to produce. Essentially we’ll need much bigger lasers [than we have now],” McKenzie says.

How big, you might ask?

Computer simulations suggest that, right now, they may need to be several football fields long and multiple storeys high. The National Ignition Factory’s laser is in a 10-story building about the size of three American football fields; China’s version in the southwest city Mianyang will be 50 per cent larger again, a size MxKenzie says “is about right”.

HB11 has a plan for its version of fusion to be widespread by the mid-2050s but it has a long way to go.

“When we achieve a neutronic hydrogen-boron fusion energy gain we’ll be on our way to Stockholm to pick up a Nobel prize,” McKenzie says.

Is it illegal or not?

Australia’s ban on nuclear fission technology for energy might apply to fusion – but also might not.

Experts spoken to by Renew Economy say there isn’t much interest within federal government to revisit nuclear rules and carve out a new area for fusion, somewhere between legal nuclear medicine and illegal fission.

But the UK and USare showing how fusion might be introduced, without dumping it in with fission.

Both countries say they won’t regulate fusion technology like fission, but instead treat the new reactors more like a particle accelerator.

That’s a framework that advocates like Bungey are pinning their hopes on, given almost every major hospital in Australia houses a particle accelerator to make nuclear medicines. These are controlled by the Australian Radiation Protection and Nuclear Safety Agency (ARPANSA) as well as a suite of other regulators.

McKenzie says the deuterium-tritium fuel might be difficult for nations to support, given both are fuels used in nuclear weapons, but generally fusion should not be affected by national bans on fission energy.

“My legal understanding is that it will not come under Australia’s nuclear ban. But yes … what the rest of the world is doing, fusion is a relatively new field with no regulations,” he says.

“The US and the UK very recently passed legislation where the nuclear fission and fusion regulators are different and they require different standards, so you’re starting to separate the two technologies and that makes a big difference.”

But it’s Italy that might be the most appropriate model for Australia because it’s coming from a total ban on nuclear energy as well, Mumgaard says.

But Italy is also un-banning fission technology after a 40-year hiatus, producing a draft law in March to set up both fission and fusion technologies.

Pros and cons

Fusion is now such a small sector in Australia that it’s hard to find one person who isn’t connected to one of the local or global companies competing to be first, cheapest, or most realistic.

UNSW’s Patrick Burr is involved with HB11 but happy to also cut through the marketing speak. Every technology, as Burr says, has its drawbacks.

The main problem today is talent. Burr says companies are already cannibalising each other’s staff, from fusion engineers, scientists, down to people in the supply chain, and educating new talent was one reason why UNSW launched the student-led tokamak project.

But there are some practical problems as well which are high on the ‘to solve’ list of the engineers.

One of the first dot points on any ‘why fusion is better’ powerpoint slide is the tiny amount of waste it produces from a reaction.

But this is misleading. The irradiated waste of a fusion plant is the whole internal structure, albeit with a hundreds of years half life instead of a thousands of years half life.

Dealing with concrete or equipment that is toxic for hundreds of years is manageable for a society, Burr says. The challenge will be figuring out how to handle the higher volumes of radioactive material.

Another drawback is the source of fuel.

The most common fuel pairing is deuterium and tritium – the former is abundant in nature, the latter is not and has a short half life. Other fuels have their own challenges, such as HB11’s boron-hydrogen method, which right now requires giant lasers to activate.

Taking a position on nuclear energy in a country like Australia, where it doesn’t exist outside the medical sector, is a bet on the distant future.

For Burr, it’s a question on whether Australia will have won the fight with hard-to-decarbonise sectors in 50 or 100 years’ time. And whether the country wants to make a bet today on a technology that may – or may not – be that solution.