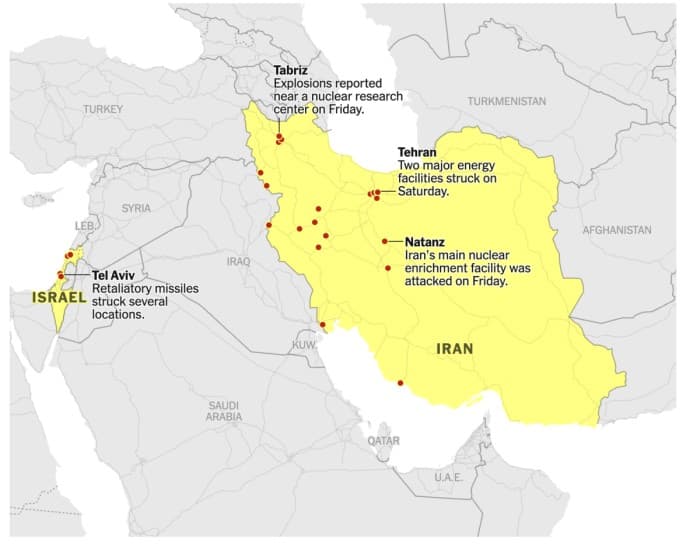

Israel launched a series of airstrikes on Tehran’s critical energy infrastructure early Sunday, setting ablaze the city’s main gas depot and a major oil refinery, as the conflict with Iran intensified into its most destructive phase yet. The attacks, part of a broader Israeli offensive targeting Iran’s energy sector, have heightened fears of a wider regional war and sent ripples through global oil markets.

Iran’s oil ministry confirmed that the Shahran fuel depot, located in an affluent neighborhood of northern Tehran, was struck, igniting a massive fire that consumed at least 11 storage tanks. Witnesses described a series of explosions that shook the city, with flames visible for miles and smoke engulfing the skyline. “The fire is terrifying; it’s massive,” said Mostafa Shams, a resident near the depot. “It’s the gasoline depots exploding one after another.”

In southern Tehran, the Shahr Rey oil refinery, one of Iran’s largest, was also hit, according to state media. Emergency crews struggled to contain the blaze, which residents said illuminated the surrounding mountains. The strikes on these facilities, vital for Iran’s domestic energy needs and export revenue, mark a significant escalation in Israel’s campaign, which began Friday with attacks on Iranian nuclear sites and military targets.

Israel’s military said its air force targeted “military assets” in Iran, but Iranian officials accused Israel of deliberately hitting civilian infrastructure. The Shahran depot, with a capacity to hold three days’ worth of Tehran’s fuel needs, supplies about 8 million liters of gasoline daily, an oil ministry official said. The attacks have raised concerns about potential fuel shortages in the capital, with residents like Shirin, who declined to give her last name for safety reasons, expressing anger at both Israel and Iran’s government for failing to protect civilians.

The energy strikes follow Israel’s Saturday attack on a section of Iran’s South Pars Gas Field, one of the world’s largest natural gas reserves. “We have entered the second phase of the war, which is extremely dangerous and destructive,” said Abdollah Babakhani, an Iran energy expert based in Germany.

Via New York Times

The escalation has roiled global oil markets, with prices surging 8% on Friday as investors braced for further disruptions. Brent crude, the international benchmark, hovered near six-month highs, and analysts expect volatility when markets reopen late Sunday.

“For now, you get spikes in the oil price, but there’s no clear sign we’re moving toward a no-return scenario,” said Samy Chaar, chief economist at Lombard Odier. He noted that potential disruptions to Iranian oil supplies could be offset by increased output from other producers, but prolonged conflict could challenge central banks’ efforts to manage inflation, especially amid U.S. trade tariffs under President Donald Trump.

Investors remain cautious, with U.S. stock futures set to resume trading Sunday evening. The Cboe Volatility Index, a measure of market fear, closed at 20.82 on Friday, its highest in three weeks.

“The overall risk profile from the geopolitical situation is too high,” said Alex Morris, chief investment officer at F/m Investments in Washington.

The attacks have fueled broader regional tensions. Israel also bombed Yemen overnight, targeting a senior Houthi military leader, while Iran launched about 200 ballistic missiles at Israel, killing eight civilians and injuring dozens, according to Israeli authorities. The Houthis, backed by Iran, fired additional missiles at Israel, further complicating the conflict.

The conflict has scuttled U.S.-Iran nuclear talks scheduled for Sunday in Oman, dimming prospects for de-escalation. President Trump, while denying U.S. involvement in Israel’s strikes, warned Iran against attacking American interests, promising “overwhelming force” in response.

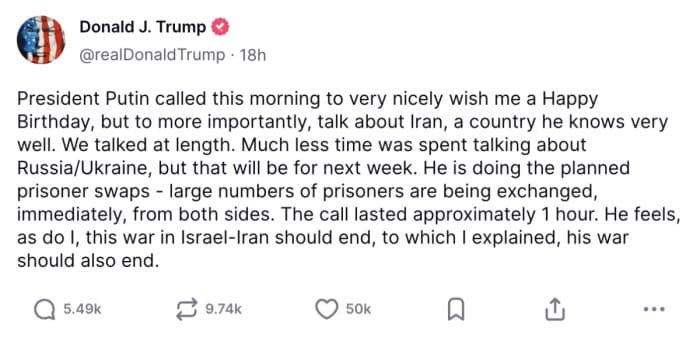

Russian President Vladimir Putin, in a call with Trump, condemned Israel’s actions and offered to mediate, though it's clear Putin's influence in the region is waning.

As Tehran grapples with the destruction of its energy infrastructure, residents expressed fear and uncertainty.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com

- Pakistan Strikes Critical Win With Oil, Gas Wildcat Discovery

- EU to Require EU Firms to Disclose Details of Russian Gas Contracts

- Oil Prices Soar After Israel Targets Iran's Nuclear Program