Best Payday Loans (Same Day) with No Credit Check and Same Day Approval 2025 – Fast Cash Online Instant Payday Loans for Quick Funding - Viva PayDay Loans

/EIN News/ -- New York City, NY, May 21, 2025 (GLOBE NEWSWIRE) --

When life throws you a curveball—like an unexpected car repair, a last-minute medical bill, or an urgent home expense—waiting for your next paycheck isn’t always an option.

That’s where payday loans step in, offering a lifeline for people who need fast cash.

These short-term loans are designed to help you cover emergency expenses quickly, so you can get back on your feet without the stress of financial uncertainty.

Get an answer in 2 minutes!

< CLICK for Same Day Loans Online No Credit Check Instant & Guaranteed Approval >

Viva Payday Loans Review 2025: The Easiest Way to Fast Cash Online

Life can throw you financial curveballs when you least expect it—an unexpected medical bill, a last-minute car repair, or just that awkward moment when payday is still days away but your wallet is already empty.

In these moments, you need a solution that’s fast, reliable, and doesn’t make you jump through endless hoops.

That’s where Viva Payday Loans shines as the best payday loan platform in 2025.

< CLICK to apply for same day loan same day approval now >

Why Choose Viva Payday Loans?

Viva Payday Loans has redefined what it means to get a quick cash loan in the USA. Forget about stressful bank visits, mountains of paperwork, and worrying about your credit score. Viva Payday Loans makes the entire process simple, transparent, and tailored to real people—no matter your situation.

With Viva Payday Loans, you can borrow anywhere from $100 up to $5,000, and choose a repayment term from just 2 months up to 24 months.

Whether you’re looking for a small bridge to your next paycheck or a larger amount for a big expense, the flexibility here is unmatched.

Lightning-Fast Application & Approval

Time is money, especially in a financial emergency. With Viva Payday Loans, you won’t be left waiting and wondering.

The online application is refreshingly fast—just a couple of minutes to fill in your details, choose your loan amount and term, and submit.

The decision? You’ll have your answer in about 2 minutes. No more anxious waiting—if approved, you can expect funds direct to your checking account, often as soon as the same day or by the next business day.

< CLICK for No Credit Check Payday Loan - Instant & Guaranteed Approval >

All Credit Scores Welcome

If you’ve ever been turned down by traditional lenders because of past financial mistakes, Viva Payday Loans is a breath of fresh air.

This platform welcomes all FICO scores, including those with bad credit or limited credit history. Many payday lender partners in their network focus more on your current affordability than your credit past, so a rough patch years ago won’t keep you from getting the help you need today.

No Credit Check? No Problem.

Worried about a credit check? Viva Payday Loans offers options for no credit check payday loans.

If you need fast cash loans and want to avoid the hassle or anxiety of a traditional credit inquiry, you can still qualify as long as you meet the basic eligibility: be over 18, have a regular monthly income of at least $1,000, a permanent address, and an active checking or savings account with direct deposit.

For Every Situation

What truly sets Viva Payday Loans apart is the wide range of loan types available. Whether you’re unemployed but have alternative income, on benefits, or even need a specific amount like a $255 or $500 loan, Viva Payday Loans has solutions.

There are options for people with non-traditional income, people on SSI, and even those who prefer to use debit or prepaid cards instead of a standard bank account.

Transparent, Trusted, and User-Focused

Transparency is key at Viva Payday Loans. Interest rates are clearly stated (ranging from 5.99% to 35.99% APR), there are no upfront fees, and you always see the full repayment schedule before you commit.

The platform only works with reputable, reliable lenders, making it easy to avoid scams and hidden fees.

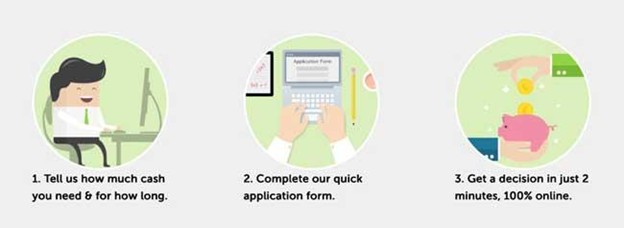

Simple Steps, Real Results

- Choose your amount and term.

- Complete the simple online form.

- Get a decision in minutes and, if approved, receive your cash fast.

It’s genuinely that easy. Plus, Viva Payday Loans’ support team is available throughout the week to answer any questions or help you through the process.

Viva Payday Loans Is Your Go-To in 2025

< CLICK for No Credit Check Payday Loan - Instant & Guaranteed Approval >

In a world where financial emergencies can happen to anyone, Viva Payday Loans is the safety net that’s fast, friendly, and truly accessible.

With flexible loan options, instant online decisions, and no judgment for past credit issues, it’s simply the smartest way to get back on your feet. If you’re looking for the best payday loan lender in 2025, look no further—Viva Payday Loans delivers exactly what you need, right when you need it.

Ready to experience the difference? Apply today and see how easy getting a payday loan can really be.

Why Payday Loans?

What makes payday loans especially attractive is their speed and accessibility. Thanks to the rise of online payday lenders, you can now apply for a loan from the comfort of your own home at any time of day. The application process is straightforward and typically takes just a few minutes to complete. Most online payday lenders offer instant approval—meaning you’ll know within moments whether you qualify—and many can deposit funds into your bank account the very same day.

Unlike traditional loans that rely heavily on your credit score, payday lenders often skip the detailed credit check or use alternative methods for approval. This means even if you have a less-than-perfect credit history, you still have a strong chance of getting approved. For many borrowers who’ve been denied elsewhere, this opens the door to much-needed funds.

Loan amounts usually range from $100 up to $1,000, depending on the lender and your individual circumstances. This flexibility allows you to borrow just what you need, without overextending yourself. With fast cash payday loans, you get a practical solution for those moments when time and money are both in short supply.

< CLICK for No Credit Check Payday Loan - Instant & Guaranteed Approval >

Understanding Payday Lenders

Now that you know how payday loans can help in a pinch, let’s take a closer look at the lenders behind them and what you should expect when applying.

How Payday Lenders Work

Payday lenders are there for those moments when you need money fast and can’t wait until your next paycheck. They offer short-term loans—usually from $100 to $1,000—with the idea that you’ll pay the money back, plus interest, as soon as you get paid again. Because these loans are so quick and easy to get, the interest rates are typically much higher than what you’d find with a traditional bank loan. The convenience comes at a cost, but for many, it’s worth it when there’s an urgent need.

What Makes a Lender Trustworthy?

Not all payday lenders are the same. The best ones—like those you’ll find through reputable online loan platforms—are upfront about their fees, interest rates, and repayment terms. They won’t try to sneak in hidden costs or confusing fine print. A good lender spells everything out in simple language, so you know exactly what you’re signing up for from the start.

What You’ll Need to Apply

Applying for a payday loan is surprisingly simple. Most lenders just ask for a few basics: a bank account to deposit your funds, proof that you have a steady income, and a valid ID. These requirements help make the process quick and safe for everyone.

About “Guaranteed Approval” Loans

You might see some payday lenders advertise “guaranteed approval,” especially if you have bad credit. While this sounds great, it’s important to be careful—these loans often come with even steeper interest rates and extra fees. Always read the terms and borrow only what you can comfortably repay.

Exploring Cash Advance Options

What Is a Cash Advance?

A cash advance is another fast and flexible way to handle surprise expenses, such as urgent car repairs or medical bills. Like payday loans, cash advances are short-term loans designed to tide you over until your next paycheck. They typically don’t require extensive paperwork, and many lenders now offer online cash advances that make the process even more convenient. With just a few clicks, you can request funds and have money deposited directly into your bank account—sometimes within hours.

How Cash Advances Can Help

For those facing a financial crunch, cash advances can be a practical solution to avoid missed payments, overdraft fees, or late charges on important bills. Many payday loan borrowers turn to cash advances when they need to bridge the gap between paychecks, especially when timing is tight.

Personal Loan Alternatives: A Smarter Way to Borrow

Why Consider a Personal Loan?

If you have time to shop around and want to save money on interest, personal loans can be a much more budget-friendly alternative to payday loans or cash advances. Personal loans typically come with lower interest rates, longer repayment periods, and larger borrowing limits. This makes them a solid choice for bigger expenses or for consolidating high-interest debts.

Where to Find Personal Loans

You can apply for personal loans through a variety of sources. Online lending platforms connect you with multiple lenders at once, allowing you to compare rates, terms, and offers in minutes. Many traditional banks and credit unions also offer personal loans with even more favorable terms, especially if you have an established relationship or good credit history.

What to Expect in the Application Process

Unlike payday loans, personal loans require a bit more information. You’ll need to submit a formal application, undergo a credit check, and often provide details about your income and employment. While this process can take a little longer, the reward is usually a lower rate and a more manageable payment plan. For many borrowers, the extra effort is well worth it for the long-term savings and financial peace of mind.

The Convenience of Online Loan Applications

Applying for Loans Has Never Been Easier

The digital age has completely transformed the way people borrow money. Today, nearly every reputable lender offers an online application process for payday loans, personal loans, and cash advances. Gone are the days of driving across town to fill out paperwork in person. Now, you can apply from your phone or computer, any time of day or night.

Fast Approvals and Same-Day Funding

Most online loan applications are designed for speed and simplicity. You’ll typically need to provide basic information—such as a valid ID, proof of income, and your bank account details. Thanks to automated approval systems, many lenders can review your application and provide an instant decision. If you’re approved, funds are often transferred the same day, putting money in your pocket when you need it most.

Comparing Your Options

Online loan platforms also make it easier than ever to shop around. You can compare multiple offers side by side, review interest rates and repayment terms, and choose the loan that best fits your needs and budget. This transparency empowers you to make smarter financial choices and avoid getting locked into a loan that doesn’t work for you.

Loan Options and Terms

When urgent financial needs arise, understanding your loan options and terms is crucial before choosing a payday lending provider.

Online payday loans are popular for their speed, but most come with very short repayment periods—often just two to four weeks—meant to be paid back by your next payday. While this quick turnaround can be helpful, the interest rates and fees for these loans are typically much higher than what you’d see with a personal loan from a bank or credit union.

Some payday loan lenders may offer slightly better terms for returning customers or those with a steady income, but these loans generally remain one of the more expensive ways to borrow.

On the other hand, personal loans usually feature longer repayment periods—sometimes stretching over several months or even years—and offer lower interest rates. Your eligibility, the loan amounts you’re offered, and even your chances of an approval will depend on factors like your credit score and history.

The good news is that many payday loan providers and credit check loans now consider borrowers with bad credit, giving more people access to much-needed funds.

Still, before signing a loan agreement, always review the fine print and compare loan amounts, fees, and repayment schedules.

Most payday loan borrowers benefit from carefully matching their loan choice to their budget and timeline, which can help prevent surprise costs or falling into a debt cycle. Taking the time to understand your options ensures you make the best decision for your financial situation.

Cash Advance App Benefits

In recent years, cash advance apps have become a popular alternative for folks who need quick cash but want to avoid the pitfalls of traditional payday loans.

These apps are designed for convenience—they usually just need you to have a bank account and a steady paycheck, and most won’t even check your credit score.

For many payday loan borrowers, this makes cash advance apps much more approachable, especially if your credit isn’t perfect.

The fees tend to be lower, and you can get money in your account fast, making them a great option for covering small, sudden expenses.

By using these apps, you can manage your finances more smoothly, avoid late fees, and steer clear of the high costs that come with payday loan lenders. They’re a solid choice if you need a little help between paychecks without taking on a lot of debt.

Credit Union Loans

If you’re looking for a more affordable way to borrow, it’s worth checking out what your local credit union has to offer.

Credit unions are known for providing personal loans with much lower interest rates and fees than most payday loan providers.

While you’ll usually need to become a member and go through a credit check, the process is often straightforward, and the terms are much more borrower-friendly.

Many payday loan borrowers find that credit union loans are perfect for things like consolidating debt, paying for a big repair, or handling unexpected bills. Plus, credit unions often go the extra mile by offering financial counseling and guidance, helping you build better money habits for the future.

If you’re tired of the high costs associated with payday loan lenders, a credit union could be a great long-term solution.

Payday Loan Regulations

Payday loan regulations can make a big difference in how safe and fair the borrowing process is for consumers.

Depending on where you live, your state might put strict limits on how much payday loan lenders can charge in interest and fees—or it might have banned payday loans altogether.

Reputable payday loan providers are required to follow both state and federal rules, such as the Truth in Lending Act, which makes sure you get all the facts about your loan upfront.

For most payday loan borrowers, it’s really important to know your rights and understand the laws in your state before signing anything.

These regulations are designed to protect you from unfair practices and help prevent debt from spiraling out of control. Always look for payday loan lenders who are transparent about their terms and who operate within the law, so you can borrow with greater confidence and peace of mind.

Managing Debt

Getting a handle on your debt is one of the smartest moves you can make, especially if you’ve relied on fast cash loans or loans online to cover emergencies like medical expenses.

Many payday lender options may seem convenient at the moment, but without a plan, it’s easy to get stuck in a cycle of borrowing.

If you’ve made past financial mistakes, you’re not alone—what matters most is taking steps to move forward. One way to get back on track is by looking into debt consolidation loans, which can bundle your balances into one payment with a structured repayment schedule.

Setting a realistic budget and tracking every dollar that goes in and out of your checking account can help you avoid overspending. If you’re unsure where to start, talking to a financial advisor or credit counselor can help you map out a plan that fits your minimum monthly income and long-term goals.

Avoiding Scams

When you’re searching for loans online, it’s so important to stay alert for scams—especially since fast cash loans often attract shady operators.

Many payday lender websites promise easy money, but always take time to research any lender before sharing your personal or checking account information.

Read reviews, look for clear loan terms, and steer clear of lenders that offer “guaranteed approval” or ask for upfront fees. Traditional lenders and reputable online providers will always be upfront about costs and won’t hide details in the fine print.

Remember, if something feels off or too good to be true, it probably is. Safeguarding your information and only working with trusted lenders helps you avoid headaches and keeps your financial journey moving in the right direction.

Applying for a Loan

Once you’ve found a lender you trust—whether it’s a traditional lender or a reputable online option—applying for loans online is usually quick and straightforward.

Most fast cash loans or payday loans will ask for basic details like your checking account, proof of minimum monthly income, and a valid ID.

Many payday lender websites offer speedy applications and even same-day funding, making it easier to handle sudden expenses like medical bills.

But before you hit “accept,” make sure you understand the full repayment schedule, interest rates, and any extra fees. Taking a few minutes to read the terms can save you from surprises later and help you make choices that support your financial health, no matter what past financial mistakes you’ve made.

Best Same Day Loans Online Summary

Viva Payday Loans stands out as the top payday loan company in 2025 for anyone seeking fast, convenient, and reliable financial help.

Their user-friendly online platform, wide range of loan options, and flexible terms make borrowing simple and stress-free, even for those with less-than-perfect credit.

With transparent rates, no hidden fees, and instant decisions, Viva Payday Loans puts your needs first—providing peace of mind when you need it most.

Whether you’re dealing with an emergency or just need a little extra cash to bridge the gap, Viva Payday Loans is truly the best choice for quick and secure payday loans in the USA. Apply today and experience financial support done right.

Legal Disclaimer & Affiliate Disclosure

The content provided in this article is for informational and educational purposes only and should not be considered financial, legal, or professional advice. While we make every effort to present accurate and up-to-date information sourced from reputable public and third-party resources, we cannot guarantee the completeness, reliability, or timeliness of the details included.

Details regarding loan amounts, interest rates, and product availability are determined by third-party lenders and may be updated or changed at any time without notice. We strongly encourage readers to conduct their own research and consult with a qualified financial advisor or legal professional before making any financial decisions.

The service discussed here—Viva Payday Loans—functions as a loan marketplace, not a direct lender. Viva Payday Loans does not issue loans or make credit decisions. Instead, the platform connects borrowers with independent lending partners, and all loan agreements, conditions, and terms are strictly between you and the selected lender.

Please note that some links or references in this article are affiliate links. If you click a link and proceed—such as by submitting a loan request or accepting an offer—we may earn a commission, at no extra cost to you. This potential compensation does not influence our editorial content or the recommendations we provide.

By using and relying on this article, you acknowledge and agree that:

- You are responsible for independently verifying lender information and loan offers.

- The content does not constitute individualized financial advice.

- The publisher and contributors are not liable for any actions or outcomes resulting from the information provided.

- All trademarks and brand names belong to their respective owners; mention of third-party services does not imply endorsement.

- For the most accurate and current loan terms, eligibility requirements, and product details, always refer to the official website of the lender.

Media Contact: Tony Stevens

Website: Vivapaydayloans.com

Email: support@vivapaydayloans.com

102 W Service Rd, Apt: 820, Champlain, NY 12919

Attachment

Contact Details

Viva PayDay Loans

Media Contact: Tony Stevens

Website: Vivapaydayloans.com

Email: support@vivapaydayloans.com

102 W Service Rd, Apt: 820, Champlain, NY 12919

Distribution channels: Banking, Finance & Investment Industry, Media, Advertising & PR

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release