From Code to Compensation: The HighStakes Race for AI Talent

As artificial intelligence continues to reshape industries and redefine how companies operate, organizations are under increasing pressure to build leadership and governance structures that can keep pace. In response, a growing number of S&P 500 companies are elevating AI to the executive level through formal leadership roles, while others are embedding oversight responsibilities into existing C-suite functions and board committees. This evolving landscape reflects not only the strategic importance of AI but also the complexity of managing its opportunities and risks across the enterprise.

At the same time, these developments are raising important questions about compensation, from how to attract specialized AI talent to how companies recognize new responsibilities taken on by existing leaders and directors. In the sections that follow, we examine how companies are structuring AI leadership and oversight today, and what this means for executive and board compensation in the years ahead.

Key Compensation Takeaways

- High-impact senior AI hires often require non-traditional pay packages – including large sign-on awards and custom vesting that go beyond existing norms, sometimes triggering Board-level review

- AI responsibility is expanding existing roles – raising questions about fair pay, internal equity, and the need to reassess benchmarks as job scopes evolve

Leadership Roles and Oversight Models

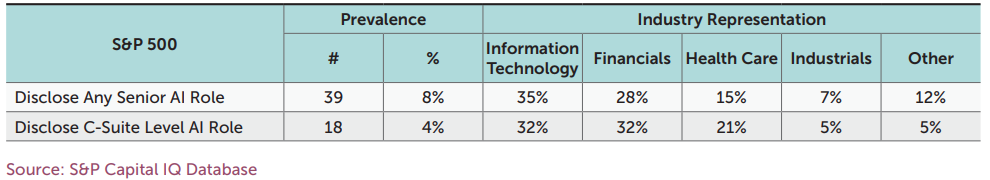

While AI is rapidly becoming a strategic priority across industries, relatively few S&P 500 companies have taken the step of assigning formally titled AI leadership roles. Only 8% have publicly disclosed a senior-level position with a direct AI focus, and just 4% have gone further by establishing a C-suite title that explicitly references artificial intelligence.

These roles – such as Chief AI & Data Officer, SVP of Data, Analytics & AI, and AI Product Manager – are disproportionately concentrated in four industries: Information Technology, Financials, Health Care, and Industrials. This industry concentration reflects both the strategic importance of AI and the degree to which companies are formalizing their AI leadership through role nomenclature. The rise of dedicated AI roles in these fields reflects both a need to scale AI responsibly and a desire to embed AI deeply into core products and operations.

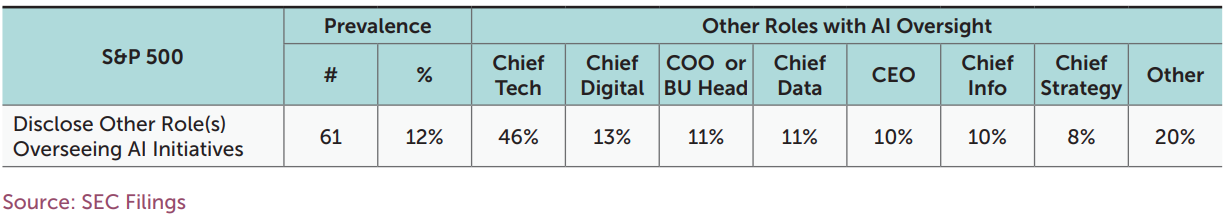

While only a small subset of S&P 500 companies have formal AI-specific executive titles, a larger group discloses that other senior leaders are responsible for overseeing AI initiatives. Specifically, 12% of companies identified at least one non-AI-titled executive with AI oversight duties. These roles span a range of functional areas, reflecting the cross-cutting nature of AI strategy within organizations.

The table below shows the distribution of roles across companies disclosing AI oversight. Unsurprisingly, the most frequently cited position is Chief Technology Officer (46%), highlighting the close alignment between AI initiatives and broader technology leadership. Other common roles vary widely, underscoring how AI responsibilities are being integrated across different strategic functions.

- Chief Digital Officer

- COO or Business Unit Head

- Chief Data Officer

- Chief Executive Officer

- Chief Information Officer

- Chief Strategy Officer

- Chief Innovation Officer

- Chief Transformation Officer

- Chief Commercial Officer

- Chief Customer Officer

- Chief Risk Officer

- Sales Leadership Roles

This data highlights that many companies are integrating AI oversight into existing leadership structures, even in the absence of AI-specific titles. It suggests that for some firms, AI is being treated as an extension of core digital, data, or technology functions rather than a standalone domain, at least at this stage of strategic development.

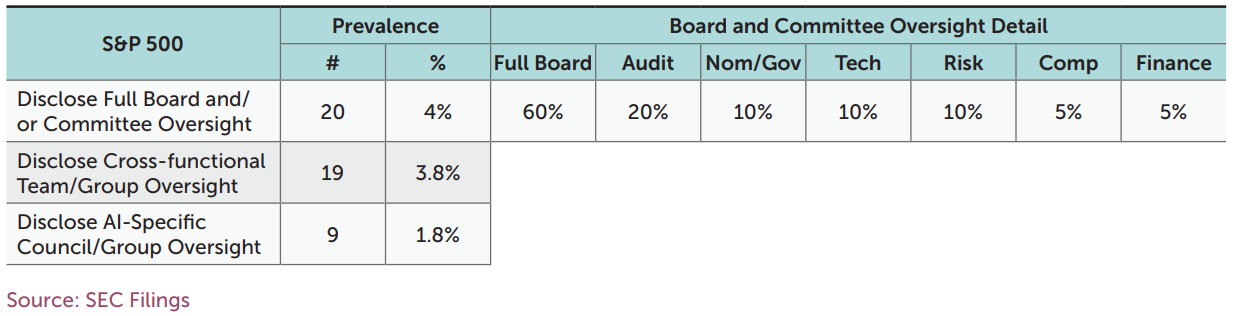

Beyond naming specific executives or titling roles to reflect AI leadership, some companies disclose broader governance structures to oversee their AI initiatives. While these disclosures are less common overall, they highlight the diverse ways organizations are embedding AI oversight across the company.

Roughly 4% of S&P 500 companies disclose board-level involvement in AI oversight, with responsibility most often assigned to the full board. Other companies note involvement by standing committees, including Audit, Nominating & Governance, Technology, Risk, Compensation, or Finance, suggesting that AI governance is beginning to be woven into existing board oversight frameworks rather than being housed in a single, consistent place.

In addition to board-related governance, some companies report cross-functional structures that support or oversee AI activities. About 4% of companies disclose the use of cross-functional teams or groups, signaling a collaborative approach that spans functions like technology, legal, operations, and strategy. A smaller subset (2%) disclose established AI-specific councils or groups, suggesting a more formalized, centralized body focused exclusively on guiding AI strategy, deployment, and risk management.

These structures, whether at the board level, within cross-functional groups, or through AI-focused bodies, demonstrate the varied and still-developing approaches companies are taking to organize and operationalize AI oversight. Together with the role-based governance described earlier, they point to a landscape in which companies are experimenting with different oversight models based on their size, sector, and strategic priorities.

Compensation Implications of AI-Related Leadership and Oversight

As companies expand their leadership and oversight structures to address AI-related opportunities and risks, new implications are emerging for both executive and director compensation. These trends are unfolding across multiple fronts:

First, the recruitment of specialized AI and technology talent, especially individuals with advanced technical credentials or experience leading AI-driven innovation, can carry a significant cost. Much of this talent pool is concentrated within large, well-resourced technology companies or venture-backed AI startups. As a result, attracting these individuals often requires customized compensation packages, including sizable sign-on awards with non-standard vesting schedules. In many cases, these awards are large enough to require Compensation Committee approval, leading to a notable increase in Committee- and Board-level engagement around talent strategy in the AI and broader technology domains.

The integration of AI talent at the non-executive level also presents pay equity considerations. In some instances, market-competitive compensation for AI specialists may push up against or even exceed that of existing executives within the same or adjacent functions. This dynamic has the potential to create internal tension if not carefully managed. Organizations should proactively set expectations, be ready to communicate the rationale for these compensation decisions, and revisit internal compensation structures to ensure fairness and alignment with strategy.

For existing executives and employees whose roles are expanding to include AI-related responsibilities, companies may need to make additional investments in training and upskilling. As these roles evolve in complexity, organizations should assess whether current compensation structures appropriately reflect the changing scope of responsibility. Benchmarking to emerging market data, while still limited, will become increasingly important in ensuring pay remains aligned with role content and performance expectations.

At the governance level, current oversight of AI is most often incorporated into the mandates of existing Board Committees, such as Audit, Risk, or Technology, rather than prompting the formation of new Committees. Looking ahead, we may see the creation of dedicated Technology, Risk, or Cybersecurity Committees, increased recruitment of directors with AI expertise, and adjustments to Committee-level compensation in recognition of expanding oversight duties. These changes will likely unfold gradually as companies continue to assess the strategic and risk-related implications of AI at the Board level.

Conclusion

As companies adapt their leadership and oversight structures to meet the demands of AI, compensation is becoming a key lever. Recruiting specialized AI talent often requires customized, high-value pay packages, sometimes exceeding standard frameworks and prompting greater Compensation Committee involvement. Internally, these dynamics raise questions around pay equity and performance alignment, especially as existing executives assume AI-related responsibilities that may shift role complexity and market benchmarks. At the board level, expanded committee mandates tied to AI oversight could eventually influence director pay, particularly where responsibilities grow meaningfully.

While many practices are still taking shape, the evolving AI landscape is already influencing compensation strategies in visible and important ways.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release