Asset Monitoring Market Size to Hit USD 2.07 Billion by 2031, Favorable Government Regulation for Asset Management Propels | The Insight Partners

The report runs an in-depth analysis of market trends, key players, and future opportunities. In general, the Global Asset Monitoring Market comprises a vast array of components, enterprise size, and end-user industry, which is expected to register strength during the forecast period.

/EIN News/ -- US & Canada, May 26, 2025 (GLOBE NEWSWIRE) -- According to a new comprehensive report from The Insight Partners, the Global Asset Monitoring Market is observing significant growth owing to favorable government regulation for asset management and the rising adoption of IoT-based asset monitoring across industries.

The Asset Monitoring market is expanding rapidly, driven by the adoption of IoT, AI, and cloud technologies that enable real-time tracking, predictive maintenance, and operational efficiency. Industries such as manufacturing, energy, transportation, and healthcare rely on asset monitoring to reduce downtime and improve productivity. The market is projected to grow significantly, reaching over USD 13 billion by 2037. Key players include IBM, General Electric (GE), Siemens AG, ABB Ltd., and Schneider Electric.

To explore the valuable insights in the Asset Monitoring Market report, you can easily download a sample PDF of the report - https://www.theinsightpartners.com/sample/TIPRE00015043/

Overview of Report Findings

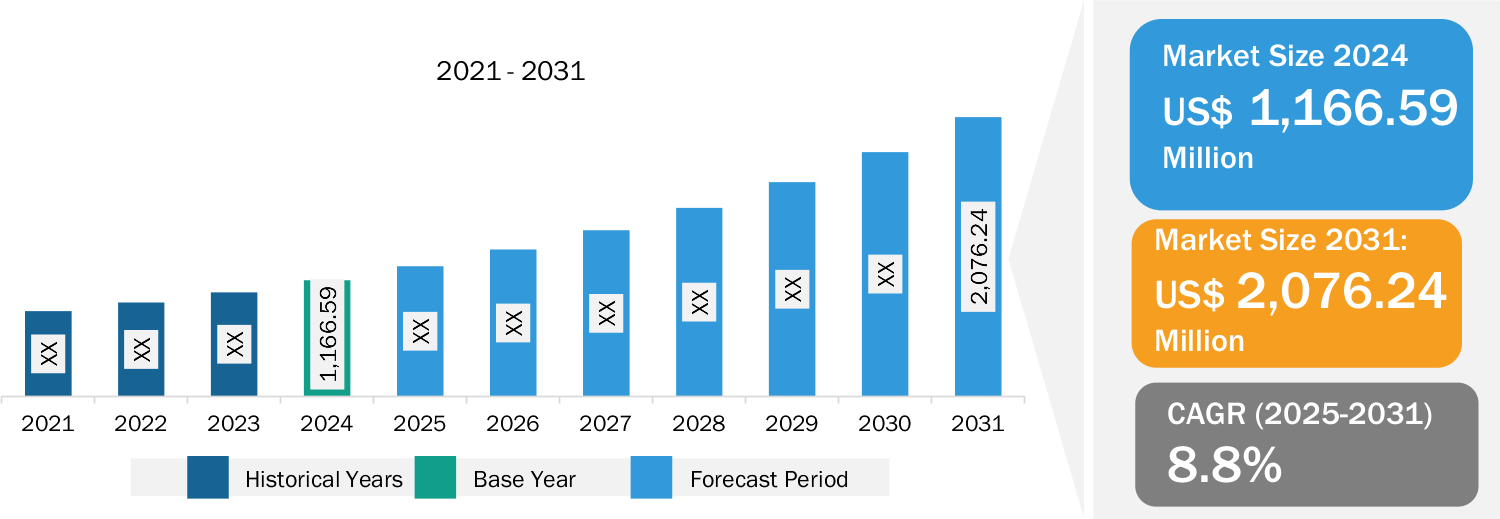

Market Growth1. : The Global Asset Monitoring Market was valued at US$ 1,166.59 million in 2024 and is projected to reach US$ 2,076.24million by 2031; it is expected to register a CAGR of 8.8% during the forecast period.

2. Government Regulation: Government initiatives are encouraging the adoption of technologically advanced asset management infrastructure with adherence to regulations. In September 2024, the government of Germany proposed an upgrade to the German Investment Ordinance that included an investment of 5% of the total collateral assets of German Pension Funds. This new quota is extremely important for asset managers raising cash for infrastructure investments and enhancing long- and short-term demand from German investors. It also supports the European Union (EU)’s aims to be climate-neutral by 2050. According to the state-owned development bank, Kreditanstalt für Wiederaufbau – KfW, Germany requires an investment of EUR 5 trillion (US$ 5.58 trillion) to achieve climate neutrality by 2045. As large-scale spending is growing in sustainability programs, the demand for technologically advanced systems and solutions has significantly increased to support businesses in monitoring their operations effectively. Asset monitoring solutions, such as sensors, IoT solutions, and data analytics platforms, are highly critical in ensuring that the assets are properly monitored and maintained to meet the carbon neutrality goals of businesses.

3. AI-based Asset Management Tools: The demand for technologically advanced solutions among industries encourages market players to develop their existing product portfolio. In November 2024, Pepperl+Fuchs developed AI-powered asset monitoring by combining experience from the Bosch Digital Twin Starter Kit. The Digital Twin Starter Kit consists of components such as powerful 12 kHz vibration sensors, an ICE2/3 IO-Link master, and the BTC22 embedded PC from Pepperl+Fuchs. This AI-based kit enables near real-time analysis of asset performance without the need to send data to a cloud server constantly. In October 2024, Salesforce, Inc. launched Connected Assets, a new suite of capabilities for Manufacturing Cloud. The AI-powered suit provides manufacturers with a comprehensive, real-time view of their connected asset data, including service history, status, and customer and telematics information; this allows manufacturers to effectively manage their assets, monitor health and performance, and act on real-time data.

4. 5G in Remote Asset Monitoring: 5G technology offers faster speeds, lower latency, and greater capacity as compared to traditional asset monitoring methods. It ensures that the data may be delivered and received more rapidly and consistently, making it an ideal solution for industries that require remote asset monitoring. This advanced technology allows businesses to monitor their assets in real-time and monitor their location, status, and condition more efficiently. 5G's ability to support a wide range of IoT devices and advanced sensors surges their demand for remote asset monitoring. With 5G, businesses and industries can connect multiple assets such as vehicles, equipment, containers, and packages, allowing them to track and monitor their entire fleet or inventory in real time; this improves operational efficiency, enhances security, and reduces the risk of theft or loss. Additionally, 5G technology allows organizations to easily integrate and use modern technologies such as AI and machine learning to evaluate and understand data acquired from remote assets. Businesses can use AI algorithms to estimate maintenance requirements, optimize routes, and discover abnormalities or potential concerns before they become more severe. This approach supports asset managers in saving their time, money, and resources.

Market Segmentation

- Based on component, the market is divided into hardware, software, and services. In terms of software, the market is bifurcated into on-premise and cloud. The hardware segment dominated the market in 2024.

- On the basis of enterprise size, the asset monitoring market is categorized as large enterprises and SMEs. The large enterprises segment dominated the market in 2024.

- In terms of end user, the market is divided into manufacturing, chemicals and petrochemicals, oil and gas, healthcare, construction, and others. The manufacturing segment dominated the market in 2024.

Get Updated Sample Copy on the Asset Monitoring Market Report: https://www.theinsightpartners.com/sample/TIPRE00015043/

Competitive Strategy and Development

- Key Players: A few major companies operating in the Global Asset Monitoring Market include Asset Monitoring Solutions Limited; Yokogawa Electric Corp; Camlin Group; Emerson Electric Co; GE Vernova Inc; Oracle Corp; ABB Ltd; SGS SA; Prysmian SpA; and International Business Machines Corp.

- Trending Topics: Remote Asset Management Market, Enterprise Asset Management Market, AI in Asset Management Market, among others

Global Headlines on Global Asset Monitoring Market

- Yokogawa Electric Corporation announced a strategic agreement aimed at dramatically enhancing asset performance management in industrial plants.

- ABB Motion has announced a strategic investment through ABB Motion Ventures in the AI start-up UptimeAI, aiming to transform how industrial customers manage the health and performance of motors, drives, and related assets.

- Emerson announced that they have improved native, out-of-the-box software and measurement features embedded in its award-winning AMS Asset Monitor CHARMs-based edge process analytics solution for monitoring industrial machinery.

Purchase Premium Copy of Global Asset Monitoring Market Size and Growth Report (2021-2031) at: https://www.theinsightpartners.com/buy/TIPRE00015043/

Conclusion

The partnership and collaboration activities to develop and supply asset monitoring with advanced features are soaring rapidly. Key players such as Asset Monitoring Solutions Limited, IFS Ultimo B.V., Yokogawa Electric Corp, Camlin Group, Emerson Electric Co, and Oracle Corp are operating in the asset monitoring market in Europe. These players are expanding their partnership agreements and collaborating with tech companies to develop innovative asset monitoring solutions that meet demand for different applications. In March 2024, IFS Ultimo B.V., a Netherlands-based company, collaborated with SPIE to help asset managers in France and the Netherlands. SPIE uses IFS Ultimo B.V’s advanced Ultimo enterprise asset management (EAM) software to support industries and their customers in maintaining their assets efficiently and effectively. IFS Ultimo B.V.’s advanced Ultimo enterprise asset management (EAM) software has a user-friendly interface that supports SPIE engineers in easy integration with multiple ERP systems and Industry 4.0 tools. This partnership between the two companies is a significant step forward in increasing the capabilities of asset monitoring solutions across Europe, particularly in the Netherlands and France.

Increasing adoption of technological hardware and software solutions among businesses in nations including Finland, Sweden, Belgium, the Netherlands, and Germany surge the demand for IoT and AI-based asset monitoring solutions. These solutions monitor and generate real-time performance data of assets, which allows asset managers to rapidly monitor each asset's status, condition, and performance, preventing unexpected interruptions and increasing productivity.

The report from The Insight Partners, therefore, provides several stakeholders—including solution providers, system integrators, and end users —with valuable insights to successfully navigate this evolving market landscape and unlock new opportunities.

Talk to Us Directly: https://tawk.to/chat/5d5a708ceb1a6b0be6083008/1i44d98rb

Trending Related Reports:

https://www.theinsightpartners.com/en/reports/iot-based-asset-tracking-and-monitoring-market

https://www.theinsightpartners.com/reports/3d-digital-asset-market

https://www.theinsightpartners.com/reports/data-center-asset-management-market

https://www.theinsightpartners.com/reports/asset-tokenization-software-market

https://www.theinsightpartners.com/reports/enterprise-asset-management-market

https://www.theinsightpartners.com/reports/digital-asset-management-market

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Home - https://www.theinsightpartners.com/

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Media, Advertising & PR, Science ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release