Carbotura Capital, LLC Announces $5 Million Foundation Round for Co-Investment in Waste-to-Circular Manufacturing

Verified Accredited Investors Gain Opportunity to Participate in Revolutionary Sustainable Materials Business

NAPLES, FL, UNITED STATES, May 20, 2025 /EINPresswire.com/ -- Carbotura Capital, LLC ("Carbotura Capital" or the "Company") today announced the launch of its $5 million Foundation Round offering, providing qualified investors access to participate in innovative Waste-to-Circular Manufacturing (WtCM) facilities. This Rule 506(c) offering under Regulation D of the Securities Act of 1933, as amended, is available exclusively to verified accredited investors, with a Regulation S supplement available for qualified non-U.S. investors.

Carbotura Capital serves as an investment vehicle designed to enable outside investors to secure rights to purchase up to 20% ownership in Carbotura's SPV facilities. The Company's parent, Carbotura, Inc., plans to develop 12 facilities over the next three years, representing potential investment rights of up to $432 million in total.

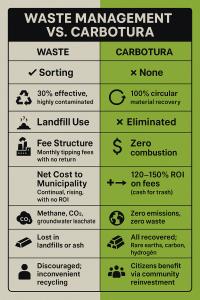

"Our Foundation Round offers verified accredited investors an entry point into the transformative waste-to-value sector," said Pelle Malmhagen, CEO of Carbotura. "Each facility will utilize proprietary technology that converts municipal solid waste into high-value renewable nanomaterials, with each facility processing 400 tons per day."

Each WtCM facility will be designed to generate multiple revenue streams, including high-purity renewable graphite, advanced nanomaterials, ultra-pure water, and recovered metals and industrial gases, with long-term contracts and multiple paths to liquidity.

The investment structure provides several key benefits to participants:

• Rights to purchase up to 20% ownership in individual facilities

• 8% annual preferred return if paid currently once stabilized (10% if accrued)

• Pro-rata participation rights among unit holders

• Tag-along rights for facility sales

• No obligation to purchase in every facility offering

"We've created an Access Company investment structure that eliminates traditional fund fees and carried interest, instead offering investors direct participation in facility economics with multiple paths to liquidity," added Allen Witters, Chairperson of Carbotura.

Investment Highlights:

• Minimum investment: $250,000 (10 Units at $25,000 each)

• Maximum offering: $5,000,000 (200 Units)

• 90% of funds reserved for investment rights

• 30-year expected facility operational lifespan

• Geographic diversification across planned facilities

IMPORTANT NOTICES:

THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER TO SELL OR SOLICITATION OF AN OFFER TO BUY ANY SECURITIES. ANY SUCH OFFER MAY ONLY BE MADE BY THE COMPANY'S PRIVATE PLACEMENT MEMORANDUM. THE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS, AND MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES ABSENT REGISTRATION OR AN APPLICABLE EXEMPTION FROM REGISTRATION REQUIREMENTS.

THE SECURITIES ARE BEING OFFERED AND SOLD ONLY TO VERIFIED "ACCREDITED INVESTORS" AS DEFINED IN RULE 501(a) OF REGULATION D UNDER THE SECURITIES ACT, WITH EACH INVESTOR'S STATUS TO BE VERIFIED AS REQUIRED UNDER RULE 506(c).

THIS INVESTMENT INVOLVES A HIGH DEGREE OF RISK. THERE IS NO GUARANTEE OF RETURNS AND INVESTORS COULD LOSE THEIR ENTIRE INVESTMENT. PLEASE REVIEW THE PRIVATE PLACEMENT MEMORANDUM CAREFULLY, INCLUDING THE "RISK FACTORS" SECTION, BEFORE MAKING AN INVESTMENT DECISION.

FOR NON-U.S. INVESTORS: THE SECURITIES ARE BEING OFFERED OUTSIDE THE UNITED STATES IN RELIANCE ON REGULATION S UNDER THE SECURITIES ACT. ADDITIONAL RESTRICTIONS APPLY TO NON-U.S. PERSONS AS DESCRIBED IN THE REGULATION S SUPPLEMENT TO THE PRIVATE PLACEMENT MEMORANDUM.

To Learn More, Visit: https://invest.carbotura.com

About Carbotura Capital, LLC Carbotura Capital, LLC serves as the investment vehicle for outside investors to participate in Carbotura's SPV facilities, enabling access to innovative Waste-to-Circular Manufacturing (WtCM) projects. By offering up to 20% ownership stakes and diversification across multiple facilities, Carbotura Capital allows investors to benefit from sustainable, zero-emission technology that transforms waste into high-value materials.

Tyler Wood

Carbotura Inc.

+1 617-899-6745

email us here

Visit us on social media:

LinkedIn

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Culture, Society & Lifestyle, Environment, International Organizations

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release